Tools Of Organizational Appraisal For Strategic Management

In order to formulate a corporate strategy and pursue its objectives, every organization must first understand itself in great detail. Understanding its own strengths & weaknesses and then matching them against the external threats & opportunities can create organizational capabilities, while safeguarding the organization from the onslaught of adverse situations. This is also called “Corporate Introspection” and this is done through ‘Organizational Appraisal’. Organizational Analysis is a process of systematically evaluating organizational capabilities which can provide a competitive advantage in the market. The capabilities enable the organization to achieve strategic advantage over its competitors for long-term success. Organizational Analysis is also known as internal analysis, corporate appraisal, self approval, company analysis etc.

Factors In Organizational Appraisal

Organizational analysis involves the identification of factors which indicate the organizational capabilities. These factors are known as organizational capability factors, competitive advantage factors or strategic factors. The following are the organizational capability factors that exist within an organization and which are critical for the formulation and implementation of strategy;

Finance

Financial capability factors are concerned with the availability, usage and management of funds. Some of the important factors which influence an organization’s financial capability are;

- Sources of funds – Financing pattern (capital structure), cost of funds, financial leverage, reserves & surplus, relationship with provider of funds, etc.

- Usage of funds – Fixed assets, current assets, loans & advances, dividend distribution.

- Management of funds – Accounting and budgeting systems, financial control system, tax planning, return risk & management etc.

Marketing

The main factors that influence the marketing capability of an organization are as follows;

- Product related factors – Product mix, branding, product positioning, differentiation, packaging etc.

- Price related factors – Pricing policies, price competitiveness, value for money pricing, price changes etc.

- Place related factors – Distribution network, transportation & logistics, relations with intermediaries etc.

- Promotion related factors – Promotional mix, promotion tools, customer relationship management etc.

- Integration and control related factors – Market standing, company image, marketing information system, marketing organization, etc.

Operations

Operations capability factors relate to the production of goods and services. Major factor influencing an organization’s operation capability are as under;

- Production System : Factors related to production system are plant location, capacity & its utilization, plant layout, product design, material supply system, degree of automation, extent of vertical integration etc.

- Operations and Control System: Factors related to operation & control system are production planning, inventory management, cost & quality control, maintenance system & procedures, etc.

- Research and Development : Factors related to research & development are product development , R & D staff, technical collaboration & support, patent rights, level of technology used etc.

Human Resources

In any organization, human resources make use of non-human resources. Human resource capabilities relate to the acquisition & use of human resources, skills, and all connected aspects that influence strategy formulation and implementation. Some of the important factors which determine human resource capability are given below.

- Factors related to the human resource system – Human resource planning, recruitment and selection, training and development, human resource mobility, appraisal and compensation management, etc.

- Factors related to employee retention – Company’s image as an employer, career development opportunities for employees, working conditions, employee benefits, employee motivation and morale etc.

- Factors related to industrial relations – Union-Management relationship, collective bargaining, grievance handling system, employee participation in management, etc.

Also Read – Environmental Appraisal – A Precursor To Strategy

Components of Organization Appraisal

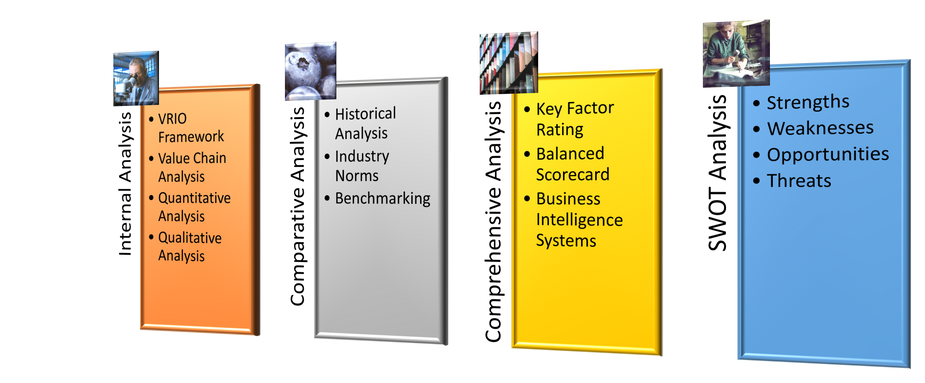

The major components of organizational appraisal are as follows;

- Internal Analysis

- Comparative Analysis

- Comprehensive Analysis

- SWOT Analysis

Internal Analysis

The internal analysis of a firm focuses and evaluates the strengths that can be leveraged and weaknesses that need to be worked upon. The techniques used in internal analysis are;

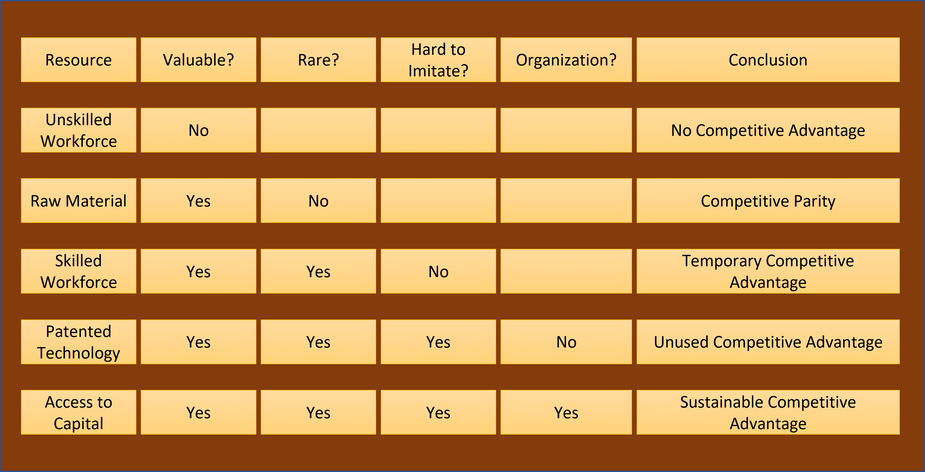

VRIO Framework

VRIO Framework stands for Valuable, Rare, Imitable and Organization. It is a resource-based evaluation to study the relevance and importance of resources available to an organization. This presents a realistic picture of the available resources, rather than a broad overview. The evaluating pointers are as described below;

Valuable – Resources that help an organization to create products that can favorably compete in the market. These resources can be in the form of technology, human resource, infrastructure, finance, proximity to the government etc.

Rare – Those resources that are valuable and that one or only a few firms in the industry exclusively possess. A unique location or a highly motivated workforce are example of rare resources.

Imitable – These are the capabilities which competitors either cannot duplicate or can duplicate only at a very high cost. Excellent corporate image or exclusive patents are example of inimitable capabilities.

Organized for usage – These are the capabilities which an organization can use through its appropriate structure, business processes, control and reward system. The availability of competent R & D personnel & research laboratory to continually string out innovative products is an example of organized for usage capability.

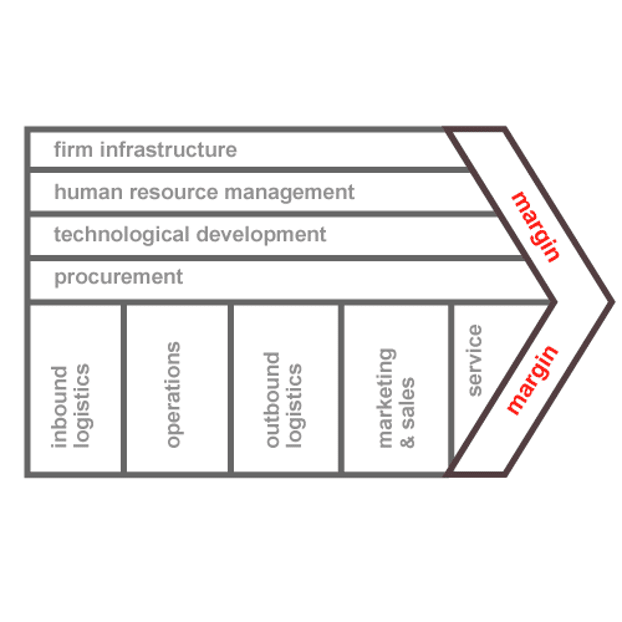

Value Chain Analysis

Every organization performs several activities. These activities are interrelated and form a chain. Each activity in the chain creates some value and involves cost. Thus, a value chain analysis is a set of interlinked and value–creating activities performed by an organization. These value-creating activities also leave a cost signature in their wake. A trade off between the generated value and the cost signature of each activity is crucial to understand the effectiveness of each activity in the organization and the overall organizational efficiency. These activities can be classified and studied as follows;

Primary Activities – These activities are directly related to the creation of goods or services. Primary activities consist of the following;

- Inbound Logistics: All the activities used for receiving, storing and transporting raw material into the production process are known as inbound logistics.

- Operations: All activities involved in the transformation of raw material into finished product are called operations.

- Outbound Logistics: All the activities used for receiving, storing and transporting finished products are known as outbound logistics.

- Marketing and sales: These consist of activities used to promote and sell goods and services to customers.

- Services: These are the activities used for enhancing and maintaining a product’s value in the market.

Support Activities – These activities provide support to the primary activities. Support activities consist of;

- Firm Infrastructure – All activities for general management of the organization to achieve its objective are called firm infrastructure.

- Human Resource Management – These comprise recruitment, selection, training, deploying and retaining the human resources of an organization.

- Technology Development – Typical activities in this category are research & development, product & process design, equipment design etc.

- Procurement – Obtaining raw materials, spare parts, supplies, machinery, equipment and other purchased items are included in procurement.

Quantitative Analysis

In quantitative analysis, both financial and nonfinancial aspects are studied as follows;

- Financial Analysis – In order to judge the strength and weaknesses in different functional areas, ratio analysis and economic value-added analysis are used.

- Non-Financial Analysis – There are several aspects of an organization which cannot be measured in financial terms. Non-financial analysis is used to assess these aspects. Employee absenteeism and turnover, advertising recall rate, production cycle time, service call rates, number of patents registered per annum, inventory turnover rate, etc. are such aspects.

Qualitative Analysis

Those aspects of an organization which cannot be expressed in quantitative terms are assessed through qualitative analysis. Corporate image, corporate culture, learning ability, employment morale, etc. are examples of these aspects. Qualitative analysis can be used to support and strengthen quantitative analysis.

Comparative Analysis

Strengths and weaknesses provide a competitive advantage to the organization when these are unique and exclusive. Therefore an organization should compare its capabilities with those of its competitors. Comparative analysis can be over a time period, based on industry norms and through bench marking.

Historical Analysis

In historical analysis an organizations strengths and weaknesses are compared over different time periods. Its reveals whether the strengths are improving or declining. Areas which show continuous improvement are durable strengths. Hofer and Schendel have developed a functional-area profile and resource deployment matrix for historical analysis. Historical analysis can even be a comparison between a company’s own performance over the years.

Industry Norms

Every industry has certain norms or standards for key parameters of performance. The performance levels of a firm can be compared with the norms of the industry in which the firm operated. For example, cost levels of Maruti Suzuki may be compared against cost standards in the car industry. A more selective approach can be to compare with firms that follow similar strategies. These firms are known as strategic group. According to Miller and Dess, a strategic group is “a cluster of competitors that share similar strategies and, therefore, compete more directly with one another than with other firms in the same industry.

Benchmarking

A benchmark means a reference point for the purpose of measurement and comparison.” Benchmarking is the process of identifying, understanding and adapting outstanding practices from within the same industry or from other businesses to help improve performance.” The basic purpose of benchmarking is to match and even surpass the best performer. The key question is benchmarking are: What to benchmark and whom to benchmark. These questions can be answered by knowing the types of bench marking . Based on what to benchmark, benchmarking is to following types;

- Performance benchmarking

- Process benchmarking

- Strategic benchmarking

- Competitive benchmarking

- Functional benchmarking

- Generic benchmarking

Comprehensive Analysis

Each of the techniques has its own benefits but fails to offer a comprehensive representation of organizational strengths and weaknesses. Comprehensive analysis is required to defeat this limitation. The techniques used in comprehensive analysis are as follows;

Key Factor Rating

In this technique the key factors as listed under are analyzed to judge their positive and negative impact on the functioning of the organization.

- Operations Capability – This involves evaluating and rating production, R&D and operations control system capability factors.

- Human Resources Capability – Skills of the employees, industrial relations and people management systems.

- General Management Capability – Organizational climate, information system and corporate relations.

Balanced Scorecard

Balanced scorecard is the most comprehensive method of analyzing an organization’s strengths and weaknesses. It integrates different perspectives with vision and strategy to present a comprehensive and balanced picture of organizational performance. The four key performance actions identified in balanced scorecard are as under;

- Financial perspective

- Customer perspective

- Internal Business Processes Perspective

- Learning and innovative perspectives

Business Intelligence Systems

Data from a range of internal and external sources are used to estimate the company’s strategic directions and operational performance. Data mining, data warehouse and analytical reports are used.

SWOT Analysis

SWOT analysis, also known as WOTS and TOWS analysis helps in understanding the internal and external environment. It is very useful in strategy formulation as the organization’s strengths and weaknesses can be matched with the opportunities and threats outside. An effective strategy makes use of the organizational strengths to capitalize on the opportunities and minimize the impact of weaknesses to neutralize the threats. After SWOT analysis, an organization has to decide how to maximize its strengths and minimize its weaknesses. It can also decide on how to exploit the opportunities and to cover the threats. The SWOT can be simplified as follows;

Strength(S): Strength is an internal competency which facilitates an organization to gain an advantage over its competitors.

Weakness (W): A weaknesses is a limitation or constraint which creates a competitive drawback for the organization.

Opportunity (O): An opportunity is an encouraging condition in the environment external to the organization. However, it is available to everyone who has the ability to leverage it.

Threat (T): A threat is an adverse condition in the environment that has the potential to negatively impact the entire industry alike. Those with adequate preparation can minimize the impact of threats.

Strength and weaknesses can be identified through organizational appraisal or analysis of the internal environment. Environmental appraisal or analysis of the external environment reveals opportunities and threats for an industry. Main advantages of SWOT analysis are that it is simple to use, inexpensive, provides a comprehensive picture of environment, and is flexible & can be adapted to different types of organizations. It serves as the basis for strategic analysis.

Related – Introduction To Strategic Management

“The essence of strategy is choosing what not to do.” – Michael Porter